You’re more essential than you think: it is crunch time for Newfoundland and Labrador employers to avail of Essential Worker Support Program

Ruth Trask and John Samms

Newfoundland and Labrador employers who continued operations this spring during Alert Levels 4 and 5 of the COVID-19 pandemic should take note of a new program offered by the provincial government that may provide extra wage supports.

The federal government pledged up to $3 billion in support to increase the wages of low-income essential workers across the country, leading the Newfoundland and Labrador government to create the Essential Worker Support Program (“EWSP”) to get this support into the hands of workers. You may not be aware of two key things: (1) the term “essential worker” is likely more broad than you expected; and (2) to avail of the program for their employees, employers must act soon.

The program provides for a lump sum payment of up to $1,500 for each essential worker who meets the eligibility criteria. The employer must apply on their behalf and upon a successful application, the funds funnel from the government, to the employer, and finally to the employee. Employers are eligible to receive an additional 10 percent of the total employee benefit, which is meant to cover its mandatory employment-related costs such as the employer’s share of CPP and EI remittances.

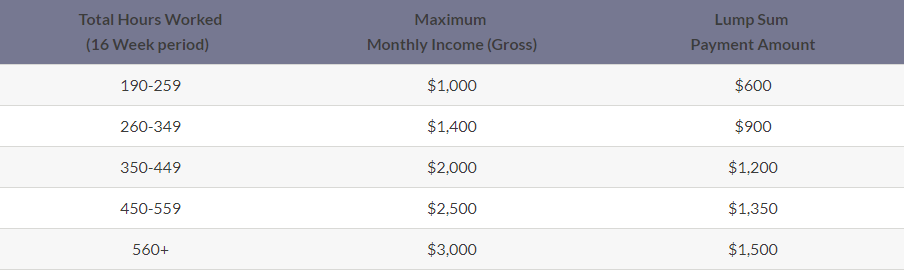

The eligibility period is for workers who worked from March 15 to July 4, 2020. The eligible benefit amounts are explained as follows on the government webpage:¹

You’re more essential than you think

Newfoundland and Labrador has followed the federal government’s lead in establishing a broad range of “essential” services which qualify for the EWSP program. If your business services fall within this group and you operated during Alert Levels 4 and 5, your business may be able to apply, even if you were operating only at a reduced capacity between March 15 and July 4.

The requirements are that an eligible essential worker must:

- Be a resident of Newfoundland and Labrador and legally authorized to work in Canada;

- Be employed or self-employed in any business or organization providing ‘essential services’ as defined by Essential Worker Listing;

- Have not received the Canadian Emergency Response Benefit (CERB) during the eligibility period;

- Have worked in both Alert Levels 4 and 5;

- Have gross earnings less than $3,000 in a month during the program eligibility period; and

- Have worked a minimum of 190 hours during the program eligibility period.

Importantly, the definition of “essential services” is quite broad, as it is “any business” providing essential services as defined by the Essential Worker Listing in the following sectors:

- Energy and Utilities

- Information and Communication Technologies

- Finance

- Health

- Food

- Water

- Transportation

- Safety

- Government

- Manufacturing

The listing at the link above provides further detailed guidance in relation to those specific sectors. Employers will need to carefully inspect this guidance document to ensure they fit within its parameters, but it is worth considering for most employers who employ eligible employees as described above. Employers are required to certify in a declaration that their employees are eligible for EWSP, which may require you to work with your employees to confirm the necessary information.

It’s crunch time

To avail of this program for your employees, employers should act fast. There is a two-step registration process. First, employers have to register to be set up as a government vendor and then complete one’s registration as an Essential Worker Employer. Government recommended that this portion of the registration process be complete before June 30, 2020, but it is not too late to apply now. Employers should start this process as soon as possible, and be mindful of the ultimate application deadline of July 30, 2020.

We are here to help

The EWSP could provide your employees with much-needed support and compensation for working during the early days of the COVID-19 pandemic, which is positive for employers and workers alike. We encourage you to review the criteria and consider applying if your employees are eligible. We would be pleased to assist you as you navigate the eligibility criteria, making the necessary inquiries of your employees and evaluating your payroll records, and completing the application process.

For more information and for access to the application forms, employers can also consult the government EWSP webpage here.

¹ https://www.gov.nl.ca/aesl/essential-workers-program/

This article is provided for general information only. If you have any questions about the above, please contact a member of our Labour and Employment group.

Click here to subscribe to Stewart McKelvey Thought Leadership articles and updates.

Archive

In Wood v. Wood et al, 2013 PESC 11, a motion pursuant to Rule 7.08 of the Rules of Civil Procedure for court approval of a settlement involving a minor, Mr. Justice John K. Mitchell approved the settlement among the…

Read MoreClients who sit on boards of corporate employers should take note of recent amendments made to New Brunswick’s Employment Standards Act (the “ESA”) which could increase their exposure to personal liability in connection with claims advanced by…

Read MoreSignificant changes may be coming to the standard automobile policy in PEI, including increases to the accident benefits available under Section B and an increase to the so-called “cap” applicable to claims for minor personal…

Read MoreOn June 17, 2013, pursuant to the recently amended Section 70 of the Labour Relations Act for Newfoundland and Labrador (“NL”), the Government of Newfoundland and Labrador issued three Special Project Orders (“SPOs”) in respect of the…

Read MoreOn June 14, 2013, the Supreme Court of Canada (“the Court”) released the decision that employers across the country were waiting for. In CEP Local 30 v. Irving Pulp & Paper Ltd., 2013 SCC 34, a…

Read MoreThe Government of Newfoundland and Labrador (“NL”) has recently released its “Aboriginal Consultation Policy on Land and Resource Development Decisions” (the “Policy”). A copy of the Policy can be accessed here. This new Policy is the…

Read MoreThe following is a province-by-province update of legislation from a busy 2013 spring session in Atlantic Canada. Watching these developments, we know the new legislation that has passed or could soon pass, will impact our…

Read MoreThe integrity of the jury system has become a pressing topic for our courts of late, with articles about jury duty frequently appearing front and centre in the press. The recent message from the Nova…

Read MoreIN THIS ISSUE: Cloud computing: House to navigate risky skies by Daniela Bassan and Michelle Chai Growing a startup by Clarence Bennett, Twila Reid and Nicholas Russon Knowing the lay of the land – Aboriginal rights and land claims in Labrador by Colm St. Roch Seviour and Steve Scruton Download…

Read MoreDOES IT APPLY TO YOU? On June 1, 2013, the Personal Health Information Act (PHIA) comes into force in Nova Scotia. If you are involved in health care in Nova Scotia, you need to know whether PHIA…

Read More