You’re more essential than you think: it is crunch time for Newfoundland and Labrador employers to avail of Essential Worker Support Program

Ruth Trask and John Samms

Newfoundland and Labrador employers who continued operations this spring during Alert Levels 4 and 5 of the COVID-19 pandemic should take note of a new program offered by the provincial government that may provide extra wage supports.

The federal government pledged up to $3 billion in support to increase the wages of low-income essential workers across the country, leading the Newfoundland and Labrador government to create the Essential Worker Support Program (“EWSP”) to get this support into the hands of workers. You may not be aware of two key things: (1) the term “essential worker” is likely more broad than you expected; and (2) to avail of the program for their employees, employers must act soon.

The program provides for a lump sum payment of up to $1,500 for each essential worker who meets the eligibility criteria. The employer must apply on their behalf and upon a successful application, the funds funnel from the government, to the employer, and finally to the employee. Employers are eligible to receive an additional 10 percent of the total employee benefit, which is meant to cover its mandatory employment-related costs such as the employer’s share of CPP and EI remittances.

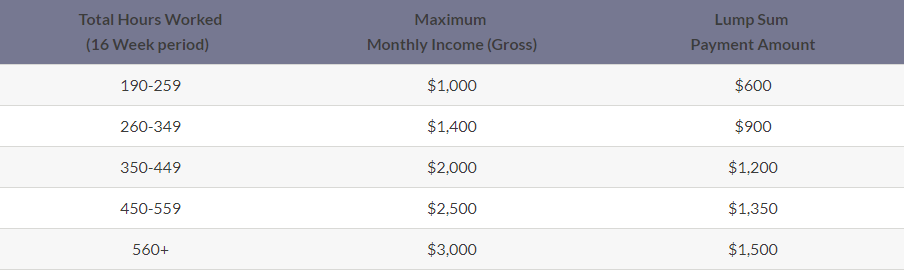

The eligibility period is for workers who worked from March 15 to July 4, 2020. The eligible benefit amounts are explained as follows on the government webpage:¹

You’re more essential than you think

Newfoundland and Labrador has followed the federal government’s lead in establishing a broad range of “essential” services which qualify for the EWSP program. If your business services fall within this group and you operated during Alert Levels 4 and 5, your business may be able to apply, even if you were operating only at a reduced capacity between March 15 and July 4.

The requirements are that an eligible essential worker must:

- Be a resident of Newfoundland and Labrador and legally authorized to work in Canada;

- Be employed or self-employed in any business or organization providing ‘essential services’ as defined by Essential Worker Listing;

- Have not received the Canadian Emergency Response Benefit (CERB) during the eligibility period;

- Have worked in both Alert Levels 4 and 5;

- Have gross earnings less than $3,000 in a month during the program eligibility period; and

- Have worked a minimum of 190 hours during the program eligibility period.

Importantly, the definition of “essential services” is quite broad, as it is “any business” providing essential services as defined by the Essential Worker Listing in the following sectors:

- Energy and Utilities

- Information and Communication Technologies

- Finance

- Health

- Food

- Water

- Transportation

- Safety

- Government

- Manufacturing

The listing at the link above provides further detailed guidance in relation to those specific sectors. Employers will need to carefully inspect this guidance document to ensure they fit within its parameters, but it is worth considering for most employers who employ eligible employees as described above. Employers are required to certify in a declaration that their employees are eligible for EWSP, which may require you to work with your employees to confirm the necessary information.

It’s crunch time

To avail of this program for your employees, employers should act fast. There is a two-step registration process. First, employers have to register to be set up as a government vendor and then complete one’s registration as an Essential Worker Employer. Government recommended that this portion of the registration process be complete before June 30, 2020, but it is not too late to apply now. Employers should start this process as soon as possible, and be mindful of the ultimate application deadline of July 30, 2020.

We are here to help

The EWSP could provide your employees with much-needed support and compensation for working during the early days of the COVID-19 pandemic, which is positive for employers and workers alike. We encourage you to review the criteria and consider applying if your employees are eligible. We would be pleased to assist you as you navigate the eligibility criteria, making the necessary inquiries of your employees and evaluating your payroll records, and completing the application process.

For more information and for access to the application forms, employers can also consult the government EWSP webpage here.

¹ https://www.gov.nl.ca/aesl/essential-workers-program/

This article is provided for general information only. If you have any questions about the above, please contact a member of our Labour and Employment group.

Click here to subscribe to Stewart McKelvey Thought Leadership articles and updates.

Archive

By Brian Tabor, QC and Colin Piercey Bill 81 and Bill 15, receiving Royal Assent in 2013 and 2014 respectively, are due to take effect this month. On June 30, 2017, amendments to the Builders’…

Read MoreNew Brunswick continues to be a thought leader in the field of regulation of recreational cannabis and provides us with a first look at what the provincial regulation of recreational cannabis might look like. New…

Read MoreRick Dunlop and Richard Jordan In Stewart v. Elk Valley Coal Corporation, 2017 SCC 30, a six-judge majority of the Supreme Court of Canada (“SCC”) confirmed a Tribunal decision which concluded that the dismissal of an…

Read MoreBy Kevin Landry New Brunswick’s Working Group on the Legalization of Cannabis released an interim report on June 20, 2017. It is a huge step forward in the legalization process and the first official look at how legalization…

Read MoreRick Dunlop and Kevin Landry As we explained in The Cannabis Act- Getting into the Weeds, the Cannabis Act introduces a regulatory regime for recreational marijuana in Canada. The regime promises to be complex. The details of legalization will be…

Read MoreOn April 1, 2017, the New Brunswick Lobbyists’ Registration Act was proclaimed into force (the “Act”), requiring active professional consultant or in-house lobbyists to register and file returns with the Office of the Integrity Commissioner of New…

Read MoreJoe Thorne and Jessica Habet How far can an insurer dig into the Plaintiff’s history to defend a claim? And how much information is an insurer entitled to have in order to do so? In English v.…

Read MoreNeil Jacobs, QC, Joe Thorne and Meaghan McCaw The Newfoundland and Labrador Court of Appeal recently confirmed that accounting/auditing firms may take on several mandates in respect of companies that may or do become insolvent in Wabush Hotel Limited…

Read MoreJoe Thorne and Brandon Gillespie An independent medical examination (“IME”) is a useful tool for insurers. An IME is an objective assessment of the claimant’s condition for the purpose of evaluating coverage and compensation. Where a…

Read MoreOn June 2, 2017 the Supreme Court of Canada released its decision in Saadati v. Moorhead, 2017 SCC 28, clarifying the evidence needed to establish mental injury. Neither expert evidence nor a diagnosed psychiatric illness…

Read More